Sacramento Bankruptcy & Debt Relief Attorney

Is debt discharged through bankruptcy considered income on taxes?

Is debt discharged through bankruptcy considered income on taxes?

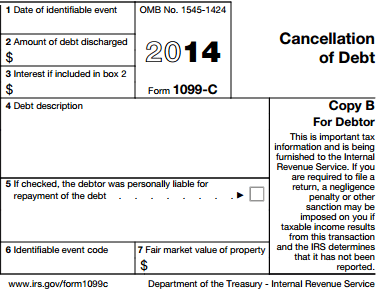

No. If a debt is forgiven or otherwise cancelled outside the bankruptcy context, that amount can be considered income on your taxes. Often people receive a 1099 (1099-C) for the amount of debt that is cancelled and must pay taxes on that amount.

Here is what a 1099 looks like for cancellation of debt income:

But if you file bankruptcy, the debt is discharged and, according to the IRS, cannot be considered income.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.