Not Alone Filing Bankruptcy

You are not alone filing bankruptcy. As this US Magazine story portrays, even celebrities file for bankruptcy. Even celebrities who earn millions file for bankruptcy. Why? The answer is simple. Debt beyond the ability to repay is a recipe for bankruptcy. This is true whether you earn millions or much less. If you cannot afford to repay your debts, bankruptcy may be the solution.

Knowing you are not alone filing bankruptcy is often a comfort to those considering bankruptcy. Thoreau was right when he spoke of people leading lives of quiet desperation. This is especially so when dealing with debt. Feeling you are alone in your debt dilemma needn’t be. Millions of others live under the canopy of debt, often believing they are alone in their plight. They are not.

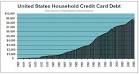

Credit availability is, obviously, tied to debt. And credit availability is now back. Much of credit market dried up during the great recession in years past. Now credit is back. So is debt. And along with it the need for debt relief. There is no more comprehensive or complete recovery from debt than filing for bankruptcy. Again, that is why you are not alone filing bankruptcy.

Credit availability is, obviously, tied to debt. And credit availability is now back. Much of credit market dried up during the great recession in years past. Now credit is back. So is debt. And along with it the need for debt relief. There is no more comprehensive or complete recovery from debt than filing for bankruptcy. Again, that is why you are not alone filing bankruptcy.

The basic premise of not being able to afford your debt is a simple concept. It is also the key to your bankruptcy eligibility. If you cannot afford to repay your debt, bankruptcy can eliminate it. Your debt can be eliminated entirely if you cannot afford to repay any of it. This is normally known as a Chapter 7 bankruptcy. If you can afford to repay a portion of your debt, bankruptcy law requires you do so. This is known as a Chapter 13 bankruptcy. Either way, bankruptcy offers debt relief by discharging, or eliminating, your debt. No matter your debt problem, bankruptcy can help. Know, too, you are not alone filing bankruptcy.

Eliminating credit card debt is the ideal solution to excess credit card debt. But that is easier said than done. Trimming expenses, paying your debt down faster and tapping your savings are all options to decrease your debt. These are great ideas. But not if they won’t work for you. Maybe your expenses are already shaved to the bone. Perhaps you can’t pay your debt off any faster. And what if you have no savings? If so, credit card debt elimination in bankruptcy may be your best bet.

Eliminating credit card debt is the ideal solution to excess credit card debt. But that is easier said than done. Trimming expenses, paying your debt down faster and tapping your savings are all options to decrease your debt. These are great ideas. But not if they won’t work for you. Maybe your expenses are already shaved to the bone. Perhaps you can’t pay your debt off any faster. And what if you have no savings? If so, credit card debt elimination in bankruptcy may be your best bet. As has been pointed out, Trump’s businesses accumulated too much debt. With more debt than income to afford it, Trump and bankruptcy became a team for these businesses. Though these businesses filed for Chapter 11 Bankruptcy reorganization, the bankruptcy effect was the same as the most common consumer bankruptcies (Chapter 7 and 13) individuals file. Trump filed bankruptcy to limit and eliminate his business debt. His businesses simply couldn’t afford the debt. Bankruptcy law allowed the debt to be eliminated, lessened or refinanced through the bankruptcy court. Bankruptcy can do this for business debt. And bankruptcy can do this for personal debt. It is why businesses and individuals file for bankruptcy.

As has been pointed out, Trump’s businesses accumulated too much debt. With more debt than income to afford it, Trump and bankruptcy became a team for these businesses. Though these businesses filed for Chapter 11 Bankruptcy reorganization, the bankruptcy effect was the same as the most common consumer bankruptcies (Chapter 7 and 13) individuals file. Trump filed bankruptcy to limit and eliminate his business debt. His businesses simply couldn’t afford the debt. Bankruptcy law allowed the debt to be eliminated, lessened or refinanced through the bankruptcy court. Bankruptcy can do this for business debt. And bankruptcy can do this for personal debt. It is why businesses and individuals file for bankruptcy. Qualifying for Chapter 7 bankruptcy requires the filer to pass the bankruptcy means test. This, then, is the primary bankruptcy means test meaning. To “pass” the bankruptcy means test, the filer must demonstrate eligibility to file for Chapter 7 bankruptcy. What this means is that an individual or couple filing for Chapter 7 bankruptcy must prove eligibility for a Chapter 7 filing. To be eligible for filing Chapter 7 bankruptcy, filers must show, essentially, their living expenses exceed their income. Put another way, they owe more in living expenses than income earned. This recent news article clarifies many of the bankruptcy means tests basics.

Qualifying for Chapter 7 bankruptcy requires the filer to pass the bankruptcy means test. This, then, is the primary bankruptcy means test meaning. To “pass” the bankruptcy means test, the filer must demonstrate eligibility to file for Chapter 7 bankruptcy. What this means is that an individual or couple filing for Chapter 7 bankruptcy must prove eligibility for a Chapter 7 filing. To be eligible for filing Chapter 7 bankruptcy, filers must show, essentially, their living expenses exceed their income. Put another way, they owe more in living expenses than income earned. This recent news article clarifies many of the bankruptcy means tests basics. Often individuals view bankruptcy as a last resort. Typically it is. But bankruptcy is not about what to do with debt you can repay. It is about debt your can’t pay. It is a frustrating financial situation. Stress often accompanies the debt. The source of strife, though, is often not the debt itself, but the inability to do anything about it. This is the pragmatist premise behind Trump’s take on debt and bankruptcy.

Often individuals view bankruptcy as a last resort. Typically it is. But bankruptcy is not about what to do with debt you can repay. It is about debt your can’t pay. It is a frustrating financial situation. Stress often accompanies the debt. The source of strife, though, is often not the debt itself, but the inability to do anything about it. This is the pragmatist premise behind Trump’s take on debt and bankruptcy.

Often consumers want to repay part of their debt. Though a bankruptcy discharge of credit card debt is part of what may prompt a bankruptcy, repayment of other debts can be a factor. Cars and mortgages are commonly the types of debts that are repaid through a bankruptcy. This is particularly so when consumers are behind, or in default, with these types of loans. A common form of a Chapter 13 bankruptcy reorganization is to repay a delinquent mortgage in full and discharge all your credit card debt.

Often consumers want to repay part of their debt. Though a bankruptcy discharge of credit card debt is part of what may prompt a bankruptcy, repayment of other debts can be a factor. Cars and mortgages are commonly the types of debts that are repaid through a bankruptcy. This is particularly so when consumers are behind, or in default, with these types of loans. A common form of a Chapter 13 bankruptcy reorganization is to repay a delinquent mortgage in full and discharge all your credit card debt. Though bankruptcy is an initial negative on your credit after you file, discharging your debts at the conclusion of your bankruptcy is a big benefit. How big that benefit is to you depends on the amount of debt your discharged, or eliminated. By weighing the cost of the bankruptcy impact versus the discharged debt is the essential evaluation of whether to file for bankruptcy. If you have big debt and little income, bankruptcy may be a good option for you. If, though, your debt is not too great and your income enough to handle that debt, maybe bankruptcy is not your best bet. Every situation is different.

Though bankruptcy is an initial negative on your credit after you file, discharging your debts at the conclusion of your bankruptcy is a big benefit. How big that benefit is to you depends on the amount of debt your discharged, or eliminated. By weighing the cost of the bankruptcy impact versus the discharged debt is the essential evaluation of whether to file for bankruptcy. If you have big debt and little income, bankruptcy may be a good option for you. If, though, your debt is not too great and your income enough to handle that debt, maybe bankruptcy is not your best bet. Every situation is different. Since a wage garnishment is a form of a court order, it is often imposed involuntarily. You don’t have to allow a garnishment. It is placed there whether you want it or not. Facing such a situation, bankruptcy and wage garnishments often intertwine. Why? Because bankruptcy will stop a garnishment.

Since a wage garnishment is a form of a court order, it is often imposed involuntarily. You don’t have to allow a garnishment. It is placed there whether you want it or not. Facing such a situation, bankruptcy and wage garnishments often intertwine. Why? Because bankruptcy will stop a garnishment. When it comes to debt, beware is often overlooked. Too frequently debt plays too intimate a role in our daily lives. And so with it goes the cost. The costs of debt to consumers can be crippling. And often it is. What, then, to do?

When it comes to debt, beware is often overlooked. Too frequently debt plays too intimate a role in our daily lives. And so with it goes the cost. The costs of debt to consumers can be crippling. And often it is. What, then, to do? Your income, including your income history, is required as part of the bankruptcy process. Eligibility for certain bankruptcy filings, including both Chapter 7 & 13 filings, depend on the amount of income you earn. To file for Chapter 7 bankruptcy, your income must be lower than your expenses. For a Chapter 13 bankruptcy your must earn more than you spend. Whatever bankruptcy option you need, you must disclose accurate financial facts.

Your income, including your income history, is required as part of the bankruptcy process. Eligibility for certain bankruptcy filings, including both Chapter 7 & 13 filings, depend on the amount of income you earn. To file for Chapter 7 bankruptcy, your income must be lower than your expenses. For a Chapter 13 bankruptcy your must earn more than you spend. Whatever bankruptcy option you need, you must disclose accurate financial facts. It is common for people to be overpaid by the EDD and SSA for unemployment and other benefits. Millions of people file for and receive such benefits. Instruction and oversight covering the application for these benefits, though, is slight. Sometimes the money paid does not match the benefits earned. When the EDD or SSA finds out, debt can result. The EDD even has a link on their website concerning overpayments. But again, bankruptcy can discharge the overpayment of unemployment and Social Security Benefits.

It is common for people to be overpaid by the EDD and SSA for unemployment and other benefits. Millions of people file for and receive such benefits. Instruction and oversight covering the application for these benefits, though, is slight. Sometimes the money paid does not match the benefits earned. When the EDD or SSA finds out, debt can result. The EDD even has a link on their website concerning overpayments. But again, bankruptcy can discharge the overpayment of unemployment and Social Security Benefits. If, just considering the average credit card debt, the amount spent on interest in a few months is more than the cost of filing a bankruptcy, there is bankruptcy bang for the buck. It is easy to see why. Spending $1,500 filing for bankruptcy is less than the interest you pay on your credit cards over a few months. Spending money on your credit card interest gets you nowhere. Filing bankruptcy gets you a discharge and your debt is done.

If, just considering the average credit card debt, the amount spent on interest in a few months is more than the cost of filing a bankruptcy, there is bankruptcy bang for the buck. It is easy to see why. Spending $1,500 filing for bankruptcy is less than the interest you pay on your credit cards over a few months. Spending money on your credit card interest gets you nowhere. Filing bankruptcy gets you a discharge and your debt is done. College costs have exploded and, along with it, debt. College degrees, once considered financial bedrock, have not held their value compared to their costs. If your graduate from college you should earn more. Right? Often this is not so. At least when it comes to the inflated costs to get the degree. Earning $1,000 more per month does little good if that comes with a lifetime debt of $1,200 per month. The math doesn’t make sense. Perhaps, then, now is the time to evaluate whether you should be able to discharge student loans.

College costs have exploded and, along with it, debt. College degrees, once considered financial bedrock, have not held their value compared to their costs. If your graduate from college you should earn more. Right? Often this is not so. At least when it comes to the inflated costs to get the degree. Earning $1,000 more per month does little good if that comes with a lifetime debt of $1,200 per month. The math doesn’t make sense. Perhaps, then, now is the time to evaluate whether you should be able to discharge student loans. Posting pictures of property you did not disclose in a bankruptcy filing on social media is a really bad bankruptcy bad idea. Rapper 50 Cent may have put himself in this spot. Recently he posted on social media pictures of him surrounded by piles of cash. 50 Cent is in an active bankruptcy case now. If he did not disclose this money in his filing, he may be in big trouble.

Posting pictures of property you did not disclose in a bankruptcy filing on social media is a really bad bankruptcy bad idea. Rapper 50 Cent may have put himself in this spot. Recently he posted on social media pictures of him surrounded by piles of cash. 50 Cent is in an active bankruptcy case now. If he did not disclose this money in his filing, he may be in big trouble.