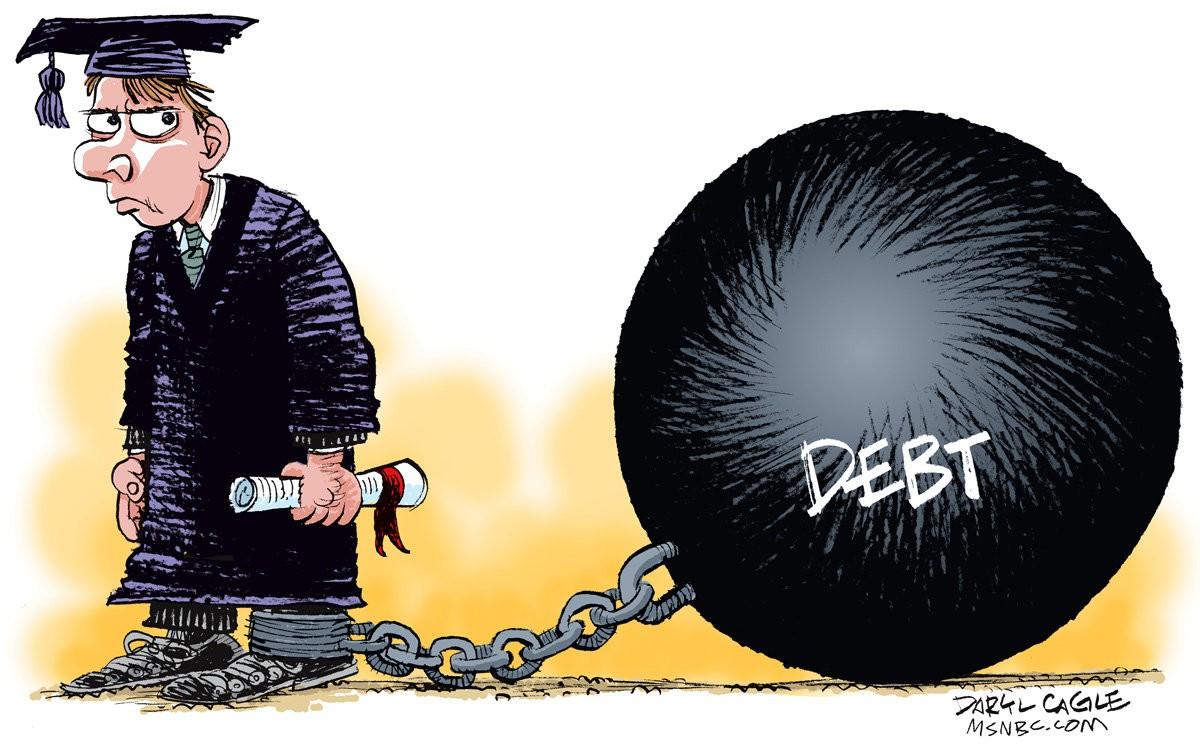

Debt can be crippling. Many in Sacramento are living with debt. And the situation is worsening. But how do you get out of debt? This recent news story offers tips to relieve your debt dilemma. But the options offered presume you have the money to, at minimum, pay down your debt. What do you do when you don't have the income to do that?

Bankruptcy OptionsBankruptcy is an option when you cannot afford the debt you have. Filing bankruptcy allows you to discharge your debt. This means your debt can be eliminated. Typically people who file bankruptcy can retain their property and still get out of debt. There is often nothing to lose. Credit is impacted by filing bankruptcy, but so is debt itself. That's where bankruptcy comes in.

When you have too much debt, something needs to be done. If you don't have the money or resources to get out of debt, the problem can only worsen. Bankruptcy is a way to get out of debt. Bankruptcy offers credit relief to those who cannot afford their debt. If you can pay your debt, even if only a portion of it, bankruptcy law requires you do so. For those who can't pay their debt, a bankruptcy discharge is often the best solution.

Though bankruptcy impacts your credit negatively, the elimination of debt is helps it. If the elimination of your debt is more beneficial than a bankruptcy filing is negative, bankruptcy should be considered. Filing bankruptcy is better done sooner than later. That's because living in debt often is worsened by going further in debt to relieve your other debt. It is a nasty spiral, and it can't be sustained.

If you are living in more debt than you can pay, I invite you to contact my office for a free consultation to evaluate your options.

Bankruptcy is a way to eliminate debt when you cannot afford to pay it back. Bankruptcy is normally considered a last financial resort. And it should. But for those who can not pay their debts it is their only resort. It is also a way to eliminate not just your debt, but the financial stress that accompanies it.

Bankruptcy is a way to eliminate debt when you cannot afford to pay it back. Bankruptcy is normally considered a last financial resort. And it should. But for those who can not pay their debts it is their only resort. It is also a way to eliminate not just your debt, but the financial stress that accompanies it. Most forms of debt are dischargeable. But some are not. The most common forms of debt that are dischargeable include credit card debt, medical bills, car repossessions (or surrenders), foreclosures, past-due rent, social security and unemployment overpayment, and more. These are all types of dischargeable debt. They can all be eliminated through the filing of bankruptcy.

Most forms of debt are dischargeable. But some are not. The most common forms of debt that are dischargeable include credit card debt, medical bills, car repossessions (or surrenders), foreclosures, past-due rent, social security and unemployment overpayment, and more. These are all types of dischargeable debt. They can all be eliminated through the filing of bankruptcy. Ambulance bills, once considered covered by insurance, no longer were for many new medical insurance policies. An extra $1,500.00 for an unanticipated health emergency could soon result in a financial emergency. Medical bill relief for many became a must.

Ambulance bills, once considered covered by insurance, no longer were for many new medical insurance policies. An extra $1,500.00 for an unanticipated health emergency could soon result in a financial emergency. Medical bill relief for many became a must.